Robert Ruel Baylosis

Alaska Mortgage Rates: Your Guide to Affordable Home Loans

It’s a cold truth as biting as an Alaskan winter: securing the best mortgage rates Alaska has to offer can be a slippery slope. But don’t worry, you’re about to strap on some financial snowshoes and trek confidently through this terrain.

You’ve probably heard whispers of how local rates stack up against those in the Lower 48. So let’s get into it—by digging into today’s numbers, demystifying first-time homebuyer programs, and peeling back the layers of loan options like juicy king crab legs—we’ll reveal how you can lock down terms that feel like hitting the Iditarod jackpot without leaving your warm cabin.

Mortgage rates in Alaska might seem daunting at first glance, but with this guide by your side? You’ll end up feeling more at home than ever.

Table Of Contents:

- Current Mortgage Rates in Alaska

- Navigating First-Time Homebuyer Programs in Alaska

- Understanding Adjustable-Rate Mortgages (ARMs) in Alaska

- Factors Influencing Your Mortgage Rate

- Comprehensive Guide to Mortgage Points in Alaska

- How to Secure Lower Mortgage Rates

- Refinancing Your Home Loan in Alaska

- Comparing Home Loans Across Alaskan Lenders

- Maximizing Benefits Through AHFC Loan Programs

- Staying Informed With Market Insights From U.S. Bank Perspectives

- FAQs in Relation to Mortgage Rates in Alaska

- Conclusion

Current Mortgage Rates in Alaska

Scouting for a home in the Last Frontier can be as thrilling as mushing through its snowy trails. But when it comes to mortgage rates, you want surprises like wildlife sightings – rare and rewarding. That’s why Alaskans keep an eagle eye on current mortgage rates, seeking those sweet spots that make homeownership more affordable.

Daily Interest Rate Updates from AHFC

Sure, interest rates might seem as unpredictable as the northern lights, but here’s some good news: The Alaska Housing Finance Corporation (AHFC) has got your back with daily updates on today’s mortgage rates. If you’re wondering about rate mortgages or just looking for the latest scoop before sunset—or 10pm to be exact—Alaska time of course—they’ve got fresh info Monday through Friday, state holidays aside. Get up-to-the-minute rate details, because knowing is half the battle.

Bear in mind though, these numbers aren’t just cold stats; they represent real cash differences in what you’ll pay over time for your slice of tundra paradise or city dwelling space alike.

Navigating First-Time Homebuyer Programs in Alaska

If you’re new to this game and feeling like a cub lost from its mama bear—don’t fret. Special programs are waiting with open arms—and potentially lower costs—for first-time buyers and veterans too. These include perks such as reduced interest payments that’ll help keep your bank account from freezing over during harsh winters. Not only could you see a dip in monthly payment amounts thanks to favorable loan rates but there’s also potential assistance with those pesky closing costs via select lenders ready to give aid where it counts most.vCheck out available closing cost help options here.

The ground rules? Well, not all who wander are lost—but if they’re looking at new purchases under specific programs they might find themselves wading into better deals than expected.

Understanding Adjustable-Rate Mortgages (ARMs) in Alaska

Talking ARMs isn’t about flexing muscles—it’s serious business for savvy borrowers keen on catching fluctuations right out of their fishing nets. With adjustable-rate mortgages’ chameleon-like ability to change periodically based on market conditions—they offer initial periods often set lower than fixed-rate counterparts which may suit certain financial strategies swimmingly well.

An ARM loan could lead down paths lined with savings—at least initially—as long as future shifts don’t catch anyone by surprise quicker than spring thaws rivers wide open again after winter freezes them solid.

Remember folks: knowledge doesn’t hibernate—even if bears do—so staying informed is key whether securing cabin logs or loans.

Key Takeaway:

Keep your eyes peeled for Alaska’s mortgage rate changes—they’re as important to track as wildlife on snowy trails. With the AHFC providing daily updates, you can snag a great deal and save big over time.

Dive into first-time homebuyer programs in Alaska that offer lower rates and help with closing costs—like finding hidden treasure in the tundra.

Adjustable-rate mortgages might start off cool but watch out—they can change faster than Alaskan seasons, so stay sharp.

Keep a sharp eye on Alaska’s mortgage rates, just like spotting wildlife—rare but rewarding. AHFC provides daily updates to help you save real money over time. First-time homebuyers and vets, look out for special programs that could lower your costs big time. And hey, ARMs can be cool if you’re ready for the rate ride—they start low but watch for changes.

Navigating First-Time Homebuyer Programs in Alaska

Alaska may be known for its rugged beauty and the Northern Lights, but it’s also home to some inviting programs that help first-time buyers plant their roots. If you’re a newcomer to the real estate game in The Last Frontier, these initiatives could make your journey from house hunting to homeowner smoother and more affordable.

Special Rates for Veterans and First-Time Buyers

The road to homeownership is paved with questions about mortgages, rates, and down payments. But if you’ve served our country or are buying your very first nest egg in Alaska, there might just be a shortcut waiting for you. Many lenders give payment assistance, offering a hand up on getting those keys without emptying every pocket.

Veterans can salute lower mortgage rates as thanks for their service while dipping into exclusive benefits tailored just for them – think of it as Uncle Sam’s housewarming gift. And let’s not forget all the non-military folks taking their initial plunge into property pools; special programs often come attached with enticing tags like reduced interest rates that don’t play hard-to-get.

If that wasn’t enough good news, how does waving goodbye to some closing costs sound? Certain lenders have got your back here too – they’ll shoulder part of this financial load so you won’t have to. For many starry-eyed shoppers eager to start their Alaskan adventure, these savings are no less than an Arctic windfall.

Daily Interest Rate Updates from AHFC

While most of us aren’t psychic enough to predict rate fluctuations at will (wouldn’t that be something?), keeping tabs on daily updates from the Alaska Housing Finance Corporation (AHFC) almost feels like having a crystal ball. These guys post new numbers Monday through Friday—except when state holidays give everyone a break—and keep them valid right up until 10 pm each business day.

Say goodbye to guessing games; instead, check out today’s mortgage rates. It’s one small step online but one giant leap toward snagging savvy loan deals before anyone else even knows they’re out there.

ARM Loan Rate Structures Explained

An Adjustable-Rate Mortgage (ARM) can seem as unpredictable as Alaskan weather—but only if you haven’t done your homework. Here’s where we strip away complexity: ARMs start off sweet with low introductory rates making early monthly payments lighter than powdery snowfall.

So, getting to grips with ARM structures is key. You’ll know exactly when your payments might change—preparing you for whatever financial weather lies ahead.

Key Takeaway:

Alaska’s first-time homebuyer programs offer a financial leg up, with special rates for veterans and newbies. Don’t miss daily rate updates from AHFC to catch the best deals. Plus, understanding ARM loans means you’re ready for any payment shifts down the road.

Alaska’s first-time homebuyer programs are like hidden gems for those ready to settle in The Last Frontier, offering special deals like lower rates and help with closing costs, especially if you’re a veteran or buying your first place.

No need for a crystal ball—keep up with Alaska Housing Finance Corporation’s daily rate updates to catch the best loan terms before they’re gone.

Understanding ARM loans means no surprises; just prepare for changes as if you’re gearing up for an Alaskan winter.

Understanding Adjustable-Rate Mortgages (ARMs) in Alaska

If you’re eyeing real estate under the Northern Lights, getting a grip on adjustable-rate mortgages can make or break your game plan. ARMs? They’re like that friend who’s predictable for a few years then suddenly changes—only with these guys, it’s your monthly payment taking the twist.

ARM Loan Rate Structures Explained

Let’s cut through the ice here: ARM loan rates start chilled out with an initial fixed period where things stay steady. But once that honeymoon phase is over, rates shift based on market trends. This means if you snagged an ARM for your Alaskan abode, don’t get too comfy; after 5 to 7 years of stability, those numbers could hike up like a trekker heading for Denali peak—or drop lower than winter temps in Fairbanks.

The magic behind this rate shuffle lies in indexes and margins—a duo as essential to ARMs as dog sleds are to mushers. Indexes track interest across our vast financial tundra while margins add extra percentage points set by lenders. Together they decide how much you’ll fork out post-fixed period when adjustments kick in annually.

Buckle up though because caps are part of this ride too. These little lifesavers put brakes on just how high or low your payments can go during each adjustment and over the life of the loan—it’s Alaska’s way of saying “We’ve got limits.”

U.S Bank offers insights into their own ARMs, breaking down how alluring starting rates often lead folks to choose them over traditional loans.

Digging deeper into Freddie Mac’s treasure trove, we find historical patterns showing us why some adventurers take their chances with these variable beasts—initially lower costs compared to fixed mortgage cousins might free up cash for tackling other parts of living large in The Last Frontier.

Note: Not all adventures have fairy-tale endings—you gotta keep tabs on current conditions because let me tell ya, if market winds blow cold, so will those future payments.

The Consumer Financial Protection Bureau dishes out even more details, including what happens when interest payment times come around without enough change from indexed hikes—the dreaded negative amortization.

So there you have it; whether staking claim near Anchorage suburbs or off-the-grid cabins by crystal-clear lakeshores—an informed homebuyer knows adjusting sails smoothly requires mastering every gusty detail about adjustable-rate mortgages.

Key Takeaway:

Adjustable-rate mortgages in Alaska are like unpredictable friends—steady at first, then full of surprises. With initial fixed periods followed by market-driven changes, they’re a mix of calm and potential storms. Caps limit how wild this ride gets, but stay sharp: if the market dips, so could your wallet.

Factors Influencing Your Mortgage Rate

Your journey to buying a home in Alaska starts with understanding how mortgage rates tick. Like the mysterious Northern Lights, several factors illuminate your individual rate, often leaving you dazzled by their complexity.

Credit Score: The Beacon of Borrowing

A shining light on your financial habits, your credit score holds significant sway over the annual percentage rate (APR) lenders offer. Stellar scores can lead to enviable rates that leave more money in your pocket for those cold Alaskan nights—think less cash towards interest and more for cozy log fires.

If you’re feeling frosty about a less-than-ideal score, remember it’s only one piece of an icy puzzle. Lenders also weigh other elements like income stability when they size up what they’ll charge you—a higher credit score simply turns up the heat on getting better terms. Get a peek at your credit report, because flying blind through finances is scarier than encountering a moose while hiking Wasatch Front trails.

Loan Amount: Scaling Financial Peaks

The loan amount is akin to choosing between hiking a hill or Mount McKinley—the greater the sum borrowed, generally means inching toward higher APRs. But don’t let this peak intimidate you; special programs exist that favor first-timers or rural buyers where interest rates apply only to the initial $250,000 regardless of how much higher you climb above sea level—or loan value.

Rural Loan Programs: Navigating Untamed Territories

Alaska’s vast wilderness offers unique borrowing landscapes through rural loan programs. These cater specifically to areas where moose might outnumber people. They offer specific incentives and different APR calculations than traditional loans but may cap at certain amounts or come with eligibility requirements as rugged as the terrain itself.

Anchoring Down Annual Percentage Rates

Finding a safe harbor with low-interest payments involves knowing how annual percentage rates affect long-term costs. Imagine if each point in your APR were an actual degree temperature drop—you’d want it as warm as possible.

The right mix could mean shaving off enough from monthly payments so savings accounts feel bulkier—or ensuring there’s always extra for impromptu sled dog races (because why not?). In any case, keeping tabs on current trends will give insight into whether now is the prime time for securing that coveted Alaskan abode without being left out in the cold financially speaking.

Key Takeaway:

Understand the factors that shape your mortgage rate in Alaska: a solid credit score can snag you lower rates, while larger loans might hike up APRs. Don’t overlook special programs for rural or first-time buyers—they could be your ticket to affordable home financing.

Your mortgage rate in Alaska is shaped by factors like your credit score and loan amount, but don’t sweat it if your score isn’t top-notch—there are special programs for first-timers and rural buyers. Keep an eye on current trends to land a deal that keeps you financially snug.

Comprehensive Guide to Mortgage Points in Alaska

Mortgage points can be a game-changer for Alaskans looking to save some cash on their home loans. Think of them like little financial elves that work tirelessly behind the scenes, chipping away at your interest rates. Now, you might wonder what these mortgage points actually are and how they shake hands with your loan costs—let’s unwrap this mystery.

The ABCs of Buying Down Your Rate

When you’re knee-deep in the world of real estate transactions, diving into the pool of mortgage options can feel more like wading through oatmeal. But here’s where mortgage points come into play—they help thin out that gruel by reducing your overall interest payment load over time. Essentially, when you buy a point, it typically shaves off about 0.25% from your loan rate; not too shabby if long-term savings is what you’re after.

Paying upfront may pinch now but think about those future paychecks waving thank-you flags because they’ve been spared from higher monthly payments. If we talk numbers—which let’s face it, we love to do—you’ll find lenders dishing out discount points as a way for buyers to snag lower percentage rates than what’s plastered on today’s mortgage billboards.

Fine Print Facts: When Points Pay Off

Digging deeper into this money-saving tactic means understanding when purchasing these bad boys makes sense for your wallet. Here’s the scoop: it all boils down to breaking even—and nope, I’m not talking dance moves here. It’s all about calculating whether those initial costs will eventually level out with the savings gained from lowered annual percentage rates (APRs).

If settling down longer than an Alaskan winter sounds like part of your plan—or maybe just sticking around until retirement age—then yes sirree Bobtail Catfishes (just go with me on this), buying points could lead to serious cost-cutting benefits over time.

No Point Left Behind: Calculating Your Break-Even Period

You’ve got options aplenty when considering different loan terms and amounts—but wait up before riding off into that snowy sunset with any ol’ deal slapped together by charming lenders or well-meaning friends who once watched a documentary on mortgages.

A break-even analysis should be top-of-mind quicker than one can say “mukluk.” This nifty calculation helps pinpoint exactly when investing in discount points shifts from being an ‘ouch’ expense towards becoming a wise choice brimming with penny-pinching potential.

Sit back while I drop some math magic without needing abacus beads clicking around—we’re about to dive into numbers in a way that’s smooth and straightforward. Let’s make those figures work for us, not against us.

Key Takeaway:

Mortgage points in Alaska can trim your loan’s interest rate, meaning upfront payment for long-term savings. If you’re setting roots or staying put until retirement, these points might just be your ticket to a slimmer monthly mortgage.

How to Secure Lower Mortgage Rates

Bagging a lower mortgage rate in Alaska isn’t just about luck; it’s about strategy. Think of your financial profile as the ultimate puzzle, where each piece—like your credit score and loan amount—affects how the final picture looks: that coveted low interest rate on your home loan.

Credit Score and Exceptional Service

Your credit score is like a secret handshake with lenders—it can open doors to better rates or keep them firmly closed. To give you an edge, aim for a score above 740; this tends to unlock some of the best deals out there. Remember though, excellent customer service from lenders matters too—they should be eager to guide you towards achieving these financial goals.

To nudge that credit score upward, pay bills on time, and keep those credit card balances low. And don’t forget, applying for new cards could ding your score temporarily—so if refinancing is on the horizon, maybe hold off on opening new accounts. Do you have a low credit score? Here’s a link to help you increase your credit score. Credit Repair Magic Will Fix Your Credit Faster than Any Other Credit Repair System at Any Price. . .Guaranteed! Click Here To Fix Your Credit Fast.

Mortgage Points: A Game-Changer?

Sometimes paying upfront can save you money down the line—that’s where buying mortgage points comes into play. Each point costs 1% of your loan amount but might reduce your interest payment enough over time to make sense financially. Do some number-crunching or chat with a savvy loan officer who’ll break down whether this move could put you ahead in Alaska’s real estate game.

Finding Your Best Fit With Loan Programs

Different strokes for different folks—and different loans for varied needs. If its flexibility you’re after or perhaps stability through fixed payments is more up your alley? You’ve got options including ARM (adjustable-rate mortgages) which may start lower than fixed-rate mortgages but remember they change with market conditions so brace yourself.

In Alaska particularly, programs tailored specifically toward veterans or first-time buyers often come paired with tantalizingly low rates not found elsewhere because let’s face it – everyone loves giving heroes and newbies alike a warm welcome.

Tackling Debt Consolidation Head-On

If existing debts are cramping style when house-hunting across The Last Frontier consider consolidating them under one roof – metaphorically speaking. Not only does debt consolidation potentially offer peace of mind by having fewer bills fluttering around each month but consolidating at a lower interest rate means less cash flying away over time too—money better spent turning that cozy cabin dream into reality instead.

Now roll up those sleeves because getting familiarized with today’s mortgage landscape is key—you’ll want all hands on deck when navigating through current rates and deciding whether locking in makes sense based on your financial situation. It’s a complex field, so let’s dive in and get a solid grip on what to expect.

Key Takeaway:

Getting a low mortgage rate in Alaska means having the right strategy. Boost your credit score, consider mortgage points, and explore loan programs tailored to you. Keep an eye on ARM risks and use debt consolidation smartly to improve financial health.

Scoring a lower mortgage rate in Alaska means getting strategic with your finances—boost that credit score, consider mortgage points, and explore loan programs for extra savings. And hey, don’t overlook consolidating debt to streamline bills and save cash in the long run.

Refinancing Your Home Loan in Alaska

If you’re nestled in the majestic beauty of Alaska and considering refinancing your home loan, there’s good news ahead. Refinancing could open doors to lower interest rates or different terms that better suit your financial landscape.

Daily Interest Rate Updates from AHFC

The heartbeat of mortgage refinancing is finding a rate that makes sense for you. Thankfully, with tools like Alaska Housing Finance Corporation (AHFC), up-to-the-minute updates are at your fingertips. The folks over at AHFC update their interest rates every weekday—yep, even when it’s -30 degrees outside—and these numbers stay put until 10pm each day unless state holidays give them a break.

Imagine sipping hot cocoa while checking out today’s mortgage rates online—that’s Alaskan-style convenience for you.

Navigating First-Time Homebuyer Programs in Alaska

Do you remember what it was like being a first-time homebuyer: the excitement mixed with nerves about stepping onto the property ladder? Well, now as someone looking to refinance, imagine helping another new buyer get those same feelings. By exploring options like streamlined refinance programs under certain conditions through AHFC, some homeowners might see an increased rate—a boost that can be significant depending on specific program guidelines.

Factors Influencing Your Mortgage Rate

Your credit score isn’t just some random number; think of it as your financial fingerprint—it’s unique to you and impacts how lenders view you big time. If high school taught us anything besides geometry we never use again—it’s that scoring matters. A strong credit score could snag you more attractive annual percentage rates because lenders love seeing borrowers who make payments faster than Usain Bolt runs.

Mortgage Points Explained Like Never Before

Sometimes paying upfront can save money down the line—even if it seems counterintuitive initially. This concept applies perfectly when discussing mortgage points during refinancing discussions here in The Last Frontier State.

Tips on Securing Lower Mortgage Rates

- Gather all relevant documents—you’ll need ’em neat and complete.

- Clean up any blemishes on your credit report—they stick out sorely.

- Showcase steady income—consistency is key.

Balloon Program Benefits Through AHFC:

- A fixed term with longer amortizations giving flexibility allows for more manageable payment schedules and can adapt to various financial situations, providing a practical solution for budgeting over time.

Key Takeaway:

Refinancing in Alaska means daily rate updates and helpful programs through AHFC, plus your credit score and mortgage points are big players in snagging lower rates.

For a smoother refinance: keep documents tidy, fix credit hiccups, prove steady income, and consider the Balloon Program for flexible payments.

Comparing Home Loans Across Alaskan Lenders

Shopping for a home loan in Alaska can feel like trying to pick the best sled dog out of an award-winning team—they all look strong, but you need the one that will go the distance with you. U.S. Bank stands out as a pack leader by offering personal banking services that include competitive home loans. Compare More Loan Options to Choose From.

Click Here To Compare More Loan Options.

Personalized Loan Solutions from Top Banks

Finding your financial fit is key when it comes to mortgages. Each lender offers its own mix of rates and terms, much like how every snowflake in our Alaskan winters is unique. Take U.S. Bank, for example; they’re known not just for their friendly smiles but also for tailoring loan options to meet various needs—from first-time buyers dreaming of log cabins to seasoned investors eyeing up downtown condos.

If variety were currency, the U.S Bank would be minting gold coins with its array of home loans available—each designed to align with different financial goals and circumstances.

The AHFC Advantage: Uniquely Alaskan Programs

AHFC (Alaska Housing Finance Corporation) plays a vital role in making homeownership more accessible through programs like Rural Owner Occupied and Non-Owner Occupied schemes or their Balloon program which features fixed terms over years yet amortizes over 30 years—a boon if you prefer predictable payments without being tied down forever.

To leverage these financing options specifically tailored for residents under the Northern Lights, savvy borrowers often turn towards AHFC’s specialized programs. It’s about finding what works best within your igloo’s budget while still giving room for future adventures across the Last Frontier.

Evaluating Competitive Rates at Your Fingertips

Sometimes securing a mortgage feels akin to panning for gold—you need patience and persistence because even tiny differences in interest percentages can lead to striking pay dirt over time. That’s why comparing current rates offered by lenders becomes crucially important; think less ‘needle in haystack’, and more ‘salmon run’ where opportunities are abundant if you know where—and when—to look.

You’ll find daily updates on today’s mortgage rates from AHFC posted Monday through Friday until 10 pm except on state holidays—that way, there are no surprises when locking down your rate during those chilly winter months or breezy summer days.

Key Takeaway:

Scouring for a home loan in Alaska? Think of U.S. Bank and AHFC as your go-to mushers, guiding you through the snowy trails with personalized loans and unique Alaskan programs. Keep an eye on daily rate updates to snag that perfect mortgage fit.

Maximizing Benefits Through AHFC Loan Programs

If you’re in Alaska and thinking about buying a home, you might feel like it’s more complicated than figuring out how to build an igloo. But here’s the good news: The Alaska Housing Finance Corporation (AHFC) offers loan programs that are as unique as the state itself, designed with Alaskans’ needs in mind.

Balloon Program – Not Just Hot Air

First off, let’s talk about the Balloon program from AHFC. It’s not what clowns at birthday parties twist into animals; it’s actually a loan option for those who don’t want their mortgage hanging over them longer than necessary. With fixed terms of 30 years and amortizations up to 30 years, this program is perfect if you’ve got plans bigger than your current financial picture allows but expect to rake in more salmon – I mean dollars – down the line.

The nifty part? If you have dreams of living amongst moose and mountains or even if your sights are set on becoming an urbanite in Anchorage or Fairbanks, there’s something for everyone. That includes specific rural owner-occupied and non-owner-occupied programs tailored just right so no matter where your Alaskan adventures take you; affordable housing follows close behind.

AHFC Loan Options – Like Layers For Winter

We all know layering up is key when facing Alaskan winters—or navigating through financing options. And speaking of layers, check out AHFC’s uniquely Alaskan loan options. These guys aren’t one-size-fits-all—they understand each borrower has different needs just like every snowflake has its own design.

Digging deeper into these loans feels less daunting knowing they offer exceptional service while helping achieve those big financial goals—whether that be cozying up in a new log cabin or investing in some prime real estate for future mushers’ training grounds.

Rural Programs – More Than Just A View Of The Northern Lights

You’d think getting lower rates would be tougher than finding a warm spot during an Alaskan winter night but fear not. For folks settling outside city limits—the heartland of bear country—rural programs shine bright by providing special treatment with interest rates applied only to the first $250k borrowed which means more money stays snugly inside your pocket next to that bear spray.

And whether it’s hunting season or house-hunting season—it doesn’t hurt knowing both owner-occupied homes AND cabins used purely for weekend getaways can qualify under these rural gems.

Taking Flight With Your Financial Dreams

Don’t hesitate to reach out if you need help or have questions. Our team is here to support you every step of the way, ensuring that your experience with us is smooth and satisfactory.

Key Takeaway:

Buying a home in Alaska? Check out AHFC’s unique loan programs tailored for every Alaskan dream, from urban living to rural retreats. They’ve got you covered with special rates and terms designed just for the Last Frontier.

Staying Informed With Market Insights From U.S. Bank Perspectives

Making sense of the financial world can feel like trying to nail jelly to a wall, but it doesn’t have to. Take market news and investing insights from seasoned pros at U.S. Bank; they’re like your trusty GPS through the ever-shifting landscape of mortgage rates and real estate buzz.

Understanding Mortgage Trends with Expert Analysis

Diving into U.S. Bank’s perspectives, you’ll get more than just dry stats. Their experts break down complex trends in a way that actually makes sense—think of them as translators turning finance-speak into plain English. This guidance is crucial when you’re deciding on something as significant as your home loan plan because let’s face it, we’d all rather watch paint dry than try to decode economic indicators without some help.

Financial planning takes patience and precision—qualities not everyone has after their third cup of coffee by 9 AM. But these insights? They’re like having a financial guru whispering sage advice in your ear, helping you make informed decisions whether for buying that cozy cabin or refinancing the family homestead.

Navigating Retirement Planning Amidst Housing Fluctuations

Your golden years should be spent enjoying Alaskan sunsets, not fretting over interest payment spikes. That’s where retirement planning comes in handy—it aligns your long-term goals with current market conditions so that nothing catches you off-guard. Whether it’s understanding how today’s mortgage rates impact your savings accounts or considering debt consolidation strategies—the right info helps keep those future beachside barbecues within reach.

Relying on U.S. Bank analysis also means getting ahead of changes before they hit headlines elsewhere—or worse yet, before they bite into your budget unexpectedly while fishing salmon out on Bristol Bay.

The Importance Of Trust And Estate Planning In Real Estate Decisions

If there were an Olympic event for juggling life responsibilities, trust and estate planning would surely qualify for the heptathlon. It juggles protection against unforeseen events while ensuring fair play between beneficiaries—a balancing act worthy of any Cirque du Soleil performance (but far less entertaining).

Real estate often represents a large slice of one’s portfolio pie; hence why savvy folks lean heavily on expert analysis provided by institutions such as U.S. Bank—they understand what “non-owner-occupied” really implies when legacy building is top-of-mind.”

Leveraging Market Insights For Homebuying Success

- Fannie Mae is a leading source of financing for mortgage lenders, ensuring affordable housing opportunities for buyers and renters across the United States.

Key Takeaway:

Think of U.S. Bank’s market insights as your financial GPS, guiding you through mortgage mazes with ease. Their expert breakdowns turn the confusing world of finance into plain English, helping you make smart home loan choices.

Don’t let market shifts catch you off-guard; use U.S. Bank’s analysis to stay ahead and keep those dreamy Alaskan sunsets in your retirement plans.

Trust and estate planning is a complex but critical part of managing real estate assets—U.S. Bank’s expertise helps ensure a smooth handover for future generations.

Leverage what pros like Fannie Mae offer—it’s all about making housing more affordable for everyone.

Exploring Additional Financial Products & Services

Mortgage rates in Alaska aren’t the only figures that savvy financial planners should keep an eye on. The world of finance offers a smorgasbord of options, from jumbo loans to gift cards, and each one has its own set of perks and quirks.

Personal Loans: More Than Just a Band-Aid for Your Wallet

A personal loan can be your financial Swiss Army knife; it’s versatile enough to cover anything from consolidating credit card debt to funding your dream wedding. With fixed interest rates typically lower than those of credit cards, this option gives you a predictable monthly payment that helps stabilize your budgeting efforts.

And if you’re worried about rate trends, fear not—personal loans usually lock in your interest rate so market fluctuations won’t ambush your wallet down the road. Shopping around is key here as lenders offer varied terms and rates based on factors like credit score and income levels. (Click here to apply.)

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

Your checking account might feel like a home base for managing day-to-day finances but don’t overlook its quieter cousin—the savings account. This dependable financial tool may not dazzle with high-interest payouts like other investments do; however, it offers unparalleled security along with some growth through accrued interest over time.

If we peek at annual percentage yields (APYs), they’ve been inching upwards lately due to Federal Reserve adjustments. And let’s face it—a solid savings stash could mean less reliance on things like payday loans when unexpected expenses pop up or even provide leverage when negotiating mortgage options down the line. Check this Savings Account that automatically transfers 10% of your deposits to an Autosave vault that earns a higher interest rate. I love this feature. It follows the rule of money that says “Pay Yourself First.” (Click here to open a savings account and receive a $325 reward.)

FAQs in Relation to Mortgage Rates in Alaska

What is the current interest rate in Alaska?

Alaska’s rates shift with the market; check out AHFC for today’s digits.

Will interest rates go down in 2024?

No crystal ball here, but experts say global economics could nudge them either way.

What is the average mortgage payment in Alaska?

The Alaskan landscape varies, and so do payments; location and loan terms are key factors.

What’s the payment on a $400,000 house?

A lot hinges on your down payment and APR. Use an online calculator to get specifics tailored to you.

Conclusion

So, you’ve journeyed through the frosty landscape of mortgage rates in Alaska. Now it’s time to warm up with your newfound knowledge.

Dive into daily updates; they’re crucial. Embrace programs for first-time homebuyers and veterans—they’re game-changers. Understand ARMs can shift like northern lights—beautiful but unpredictable.

Nail down your credit score—it shapes your rate as much as winter carves the mountains. Points make a difference; know how to use them wisely.

Refinancing? It could be your beacon in a financial blizzard. Shop around lenders; U.S Bank is just one peak in a range of options.

AHFC loan programs are tailored sleds designed for Alaskan trails—ride them well!

Stay informed, stay prepared, and remember: securing favorable terms on an Alaskan mortgage isn’t just possible—it’s within reach when armed with the right insights.

=============================================================================================================================

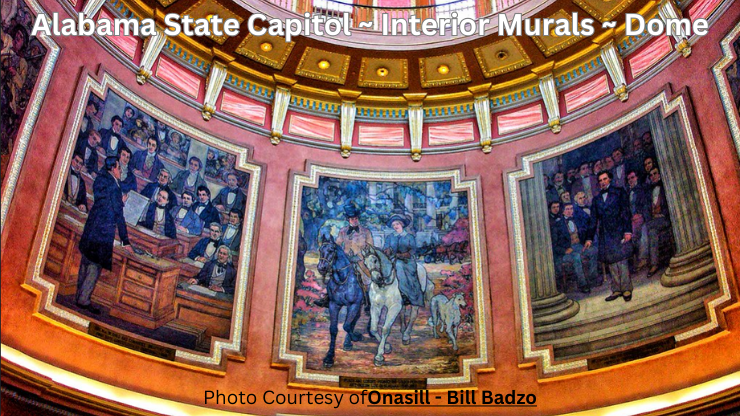

This would be a wonderful addition to your living room in your brand-new home.

Check Out These Killer Tools and Resources…

-

Credit Repair Magic Will Fix Your Credit Fast.

-

Click Here To Fix Your Credit Fast.

-

Get a $300 bonus with a SoFi Personal Loan.

-

Click Here To receive your $300 bonus.

-

Find the right personal loan rate for you.

-

Click Here To Compare your options.

-

Compare More Loan Options to Choose From.

-

Click Here To Compare More Loan Options.

-

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

-

Click here to open a savings account and receive a $325 reward.)

Affiliate Link Disclaimer:

Please note that some of the links in this article are affiliate links, and

at no additional cost to you, I may earn a commission if you decide to make a purchase.

These links help to support me and allow me to continue providing valuable content to my readers.

Current Mortgage Rates in New Hampshire: Save Big Now

Just when you thought the New Hampshire housing market had shown all its cards, current mortgage rates in New Hampshire shuffle the deck. If you’re eyeing real estate in The Granite State, understanding these rates is your ace in the hole. I remember sifting through an ocean of percentages and payment plans myself; it’s a daunting voyage but knowing what to expect makes for smoother sailing.

This piece will navigate you past common pitfalls by comparing local rates with national averages and unpacking rate trends that could influence your next move. With insights on first-time homebuyer programs and APR impacts on monthly payments, we’ll equip you for informed decisions—no guesswork needed.

Catch every wave in this dynamic market as we dive deep into how to land competitive offers tailored just right for your pocketbook. Let’s chart a course toward securing not just any loan, but one that feels like it was made with only you in mind.

Table Of Contents:

- Current Mortgage Rates in New Hampshire: A Comprehensive Guide

- How Current Rates Compare to National Averages

- Mortgage Rate Trends You Can’t Ignore

- A Peek Into First-Time Homebuyer Programs & Perks

- Understanding the Impact of APR on Your Mortgage

- Exploring Refinance Options Amidst Rising Rates

- First-Time Homebuyer Programs in New Hampshire

- Mortgage Insurance Requirements Explained

- The Effectiveness of Rate Locks During Volatile Periods

- Navigating Small Business Ownership & Residential Mortgages

- FAQs in Relation to Current Mortgage Rates in New Hampshire

- Conclusion

Current Mortgage Rates in New Hampshire: A Comprehensive Guide

If you’re eyeing the Granite State for your new home, getting a grip on today’s mortgage rates in New Hampshire is crucial. As of January 9, 2024, we’re seeing a 7.07% rate for a 30-year fixed mortgage, which has most folks doing a double-take. It’s no secret that these numbers are giving even seasoned real estate gurus something to talk about over their morning coffee.

How Current Rates Compare to National Averages

You might wonder how New Hampshire stacks up against the rest of the country when it comes to coughing up cash for your castle. Well, here’s some food for thought: The national average isn’t too far off from what we’ve got going on locally—a fact that might just put those furrowed brows at ease. But let’s be real—comparing apples-to-apples with these percentages is like trying to find two identical snowflakes during one of our nor’easters.

The thing is, while New Hampshire’s mortgage rates may hover around that 7% mark for now; savvy buyers know this dance well—the market loves leading us all in unpredictable twirls and dips. And because every penny counts when it comes down to monthly payments and long-term financial planning—you’ll want to keep an eagle eye on where things head next. Compare More Loan Options to Choose From. Click Here To Compare More Loan Options.

Mortgage Rate Trends You Can’t Ignore

Trends—they aren’t just for Twitter or TikTok; they’re also kingmakers in the world of mortgages. Spotting trends could mean snagging lower interest rates before they bounce back up again—or dodging higher ones if you can wait out the storm (figuratively speaking). Just remember: While we’ve seen more ups and downs than an arm wrestling match between Rocky Balboa and Apollo Creed lately, staying informed means you won’t get caught off-guard by sudden changes.

Hampshire housing experts, loan officers with years under their belts have seen it all—from boom times with jaw-dropping low-interest deals so sweet they’d give maple syrup a run for its money—to days when percentage points crept upward faster than sap flows in springtime. So yeah—it pays (literally) not only look at current figures but understand how past patterns play into future predictions.

A Peek Into First-Time Homebuyer Programs & Perks

Becoming part-owner of planet Earth ain’t easy—but fear not future homeowner—for there are heroes among us known as first-time homebuyer programs ready to swoop down from Mount Washington offering helping hands aplenty.

Are you just starting out? Don’t worry, we’ve all been there. Stepping into a new field can be daunting, but with the right resources and a bit of guidance, you’ll find your footing in no time. Remember that every expert was once a beginner—patience and perseverance will go a long way.

Key Takeaway:

Today’s New Hampshire mortgage rates have hit 7.07% for a 30-year fixed, sparking buzz among pros and buyers alike. Keep your eyes peeled—the market’s as unpredictable as our weather, and trends can lead to big savings or costs.

Newbie homebuyers, take heart. There are programs just for you in the Granite State that’ll help smooth out those first-time jitters and get you on solid ground.

Understanding the Impact of APR on Your Mortgage

Think of your mortgage as a long-term relationship with your finances; it’s crucial to know all about your partner, which in this case is the Annual Percentage Rate (APR). It might seem like just another percentage, but trust me, it’s more than that. The APR paints a complete picture by including not only the interest rate you’ll pay yearly but also other charges you may incur over the life of your loan.

The Nitty-Gritty of APR

Digging deeper into what makes up an APR can help save thousands down the road. Here’s why: Imagine buying a home for $300,000 with an attractive 7% interest rate offer from one lender and comparing it to another lender offering 6.5%. At first glance, option two seems cheaper right? But hold onto your hats—when fees and additional costs are bundled into that number creating what we call an APR—the story changes. Suddenly option one could come out as less expensive overall because their lower fees make their higher interest rate look good after all.

If terms like ‘interest rates’ and ‘charges’ start making you feel dizzy, don’t sweat it. Let’s say there’s no escaping these expenses—they’re part of getting a mortgage—but being informed means they won’t blindside you later on when reviewing monthly payments or total loan cost figures.

Making Sense of Changing Rates

We’ve seen some wild swings in rates lately without notice—kinda like New England weather—and keeping track is key for financial planning savvy buyers looking at homes today. If those fluctuations give you anxiety sweats thinking about how they’ll affect annual percentage rates remember this – while changes happen often due to market conditions or Federal Reserve decisions; lenders must disclose them so consumers aren’t caught off guard.

In practice though things get really interesting because sometimes small shifts mean big differences depending on whether we’re talking adjustable-rate mortgages (ARMs) versus fixed ones where percentages stay put throughout term length regardless of national averages rise or fall around them—which leads us neatly into…

Rates That Move With You: Adjustable-Rate Mortgages Explained

Gone are days when ARMs were avoided like last year’s fruitcake; nowadays smart cookies see potential here, especially during times when initial offers beat out fixed-rate counterparts hands down. How does this work? Well imagine locking in at starting percentages lower than the current average and then watching index-based adjustments potentially decrease even further over time—it sounds pretty sweet.

But before diving headfirst, let’s carefully crunch the numbers. We’ll weigh short-term gains against potential future increases. It’s important to remember that ARM loans can become unpredictable after the initial period.

Key Takeaway:

Get to know your mortgage’s APR—it includes the interest rate plus fees, which can make a big difference in cost. Keep an eye on rate changes; they impact your payments and total loan amount. ARMs might offer lower initial rates but remember they can change over time.

Exploring Refinance Options Amidst Rising Rates

If you’re a New Hampshire homeowner watching rates climb, you might think refinancing is off the table. Think again. Even as interest hikes loom large, there’s a silver lining for savvy borrowers looking to optimize their mortgage payments. It’s all about timing and strategy.

When Is the Right Time to Refinance?

The ‘right time’ isn’t one-size-fits-all; it hinges on your financial goals and current circumstances. Yes, refinance rates in New Hampshire are typically higher than purchase rates—this we know—but don’t let that deter you from exploring options tailored to your needs.

Mulling over a rate-and-term refi could lead to significant savings if your credit score has improved or if you can snag a shorter loan term with manageable payments. And while today’s mortgage rates may seem daunting compared to yesteryear’s bargains, they still beat historical highs by miles—and that means opportunity.

Let me give it straight—sometimes when the market zigs, you’ve got to zag. If inflation fears push up long-term interest costs like 30-year fixed mortgages or jumbo loans—a strategic switch into an adjustable-rate mortgage (ARM) could be just the ticket for lower initial monthly payments before those later adjustments kick in.

Navigating Highs and Lows of Rate Trends Mortgage Planning

Digging deeper into this world of digits and decimals shows us something intriguing: trends mortgage rate watchers obsess over actually serve up clues on when locking down refinance rates in New Hampshire makes sense financially speaking.

An upward trend signals quick action—to lock in before further increases hit home budgets hard with larger monthly payments or require more out-of-pocket at closing times because remember folks—we want those extra bucks for beach days no bank fees.

Compare lenders side by side, and do some number-crunching yourself too; comparing national averages against what local lenders offer can highlight whether staying put or making moves is best given current conditions.

Credit Profile Perks & Pitfalls When Chasing Lower Payments

Your credit profile does more heavy lifting here than many realize—it affects which doors open up offering inviting terms versus ones slamming shut fast due partly thanks to our friend APR (annual percentage rate).

To unlock stellar deals amidst rising tide annual percentage rate concerns:

- Aim high credit scores—they sweet-talk lenders into better offers including but not limited to tempting teaser percentages upfront arm loans among other goodies waiting for ripe picking;

- Budget buster beware: Closing costs aren’t always transparent, so getting the full scoop ahead of time saves you from unexpected expenses. Make sure to ask for a detailed list of fees before closing on a property.

Strengthen Your Credit Score

A strong credit score doesn’t just open doors; it also lowers interest rates. Think of your credit score as a financial report card that lenders use to decide if you’re worthy of a low rate. To beef up your score, start by snagging a free copy of your credit report from AnnualCreditReport.com. Look for errors and get them fixed ASAP.

Paying bills on time is like hitting home runs for your credit history—it boosts your average big time. And let’s not forget about debt—knocking down high balances can make lenders eager to give you better terms when it comes to loan options. Do you have a low credit score? Here’s a link to help you increase your credit score. Credit Repair Magic Will Fix Your Credit Faster than Any Other Credit Repair System at Any Price. . .Guaranteed! Click Here To Fix Your Credit Fast.

Key Takeaway:

Don’t let rising rates scare you off—refinancing in New Hampshire could still be a smart move. It’s about finding the right time and strategy for your situation, whether that’s improving terms with a better credit score or considering an adjustable-rate mortgage to keep initial payments low.

Dive into the numbers, compare lenders carefully, and remember: your credit score opens doors to savings even as interest rates rise. Watch out for closing costs—they can sneak up on you if you’re not careful.

First-Time Homebuyer Programs in New Hampshire

Flying solo through the real estate market can feel like trying to find a black cat in a coal cellar. But here’s some good news for you, newbie homebuyers: New Hampshire rolls out the red carpet with programs just for folks like you looking to snag their slice of the American Dream.

Benefits of State-Sponsored Buyer Assistance

Let’s talk turkey about what’s cooking in New Hampshire. The state is dishing out assistance that could sweeten your deal on a new pad. With housing assistance programs tailored for first-time buyers, there’s help available whether you’re scrimping and saving or just short on closing costs.

Say goodbye to sleepless nights fretting over down payments because these programs are designed to cushion your wallet from those hefty upfront costs. And if interest rates have been scaring you more than a horror movie marathon, know that some buyer assistance offerings might lock in more favorable terms than you’d get flying solo.

Housing Assistance Programs at Your Service

Buckle up as we take this scenic drive-through mortgage land. First stop: tax credits—because who doesn’t love paying less come April? If Uncle Sam usually takes too big of a bite from your budget pie, these credits can be like finding an extra cherry on top.

Climbing aboard one of these first-time homebuyer programs means potentially getting access to lower-than-advertised interest rates too—and let me tell ya, they’re already sitting pretty compared to the national average.

Dive deeper into New Hampshire’s treasure trove of homebuyer support right here.

The Real Deal About Monthly Mortgage Payments

Moving onto monthly payments—you know, that constant reminder that adulthood is indeed relentless. While no one enjoys parting ways with hard-earned cash each month, state-sponsored aid might ease those numbers downward so they don’t haunt your dreams quite as much.

And before visions of pesky private mortgage insurance dance in your head—it may not even be invited to this party. Some options catered toward fledgling buyers ditch PMI requirements faster than kids dodging chores; now isn’t that something?

Find out how different loan offers shape up when it comes time for repayment by clicking here.

Navigating Credit Scores and More Fun Financial Stuff

A credit score isn’t everything but try telling that to lenders who clutch them closer than their morning coffee mug. However, fear not future homeowners—for there are ways to get into a home of your own without perfect credit. By understanding the lending process and exploring different financing options, you can navigate the path to homeownership with greater confidence and ease. Get a peek at your credit report annually, because flying blind through finances is scarier than encountering a moose while hiking Wasatch Front trails.

Key Takeaway:

Hit the ground running in New Hampshire’s real estate scene with state programs that ease first-time homebuyers into ownership. Enjoy perks like down payment help, and tax credits, and maybe even score a deal on interest rates and monthly payments without the nightmare of PMI.

Mortgage Insurance Requirements Explained

Cracking the code on mortgage insurance in New Hampshire doesn’t have to feel like you’re trying to solve a Rubik’s Cube blindfolded. When it comes down to brass tacks, whether or not you’ll need this financial safeguard hinges on your down payment and lender stipulations.

Picture this: You’ve found the perfect little corner of The Granite State for your new home. But then, as things get real with numbers and monthly payments, someone throws in “mortgage insurance” into the mix. It’s pretty straightforward—when your down payment is less than 20% of the purchase price, most lenders will ask you to secure mortgage insurance. This protects them if things go south and you can’t make your payments anymore.

If digging through additional resources feels about as appealing as watching paint dry but still necessary, consider taking a gander at Additional New Hampshire Mortgage Resources. They can offer up more nuggets of wisdom on navigating these waters.

How Lender Policies Vary

The thing about lenders is they’re kind of like snowflakes—no two are exactly alike when it comes to their requirements for mortgage insurance. Some might give you a pat on the back with just 15% down without needing extra coverage while others stick firmly by that 20%. Then there are those who spice things up even more with different rates based on credit scores or loan types; talk about variety.

To ensure no surprises jump out at you like an unexpected cameo in a horror flick, always ask upfront what each lender’s policy spells out regarding mortgage insurance requirements. Let me tell ya, I’ve seen some folks blindsided because they didn’t do their homework here—it ain’t pretty. Knowledge is power after all; especially when that knowledge helps keep money in your pocket instead of shelling out extra every month for premiums.

Breathe easy though; many times these policies are designed around making homeownership accessible—not putting hurdles before the finish lines. So let’s say hello to exploring options together:

- FHA Loans: These bad boys often require mortgage insurance regardless of how much dough you put down initially—but hey, easier qualification criteria.

- Conventional Loans: Here’s where that magical number – usually around 20% – plays its part again;

- Lender-Paid Mortgage Insurance (LPMI): A bit unconventional maybe? Sure. But sometimes opting for higher interest rates over paying PMI could save bucks long-term—a slick move worth considering.

Remember—the goal isn’t just to complete the task; it’s about achieving results that stand out. It’s not enough to simply finish; we strive for excellence in every project we tackle. So, let’s put our best foot forward and make a mark with work that truly shines.

Key Takeaway:

Getting a grip on mortgage insurance in New Hampshire means knowing your down payment and lender’s rules. Less than 20% down usually calls for coverage to protect the lender. Different lenders have different vibes—some are cool with less, others not so much. Always check their playbook before you jump into the game.

FHA loans always need insurance, but they’re also easier to get into. Conventional loans? Aim for that 20%. And don’t sleep on LPMI—it could be a smart move if it means dodging monthly premiums even though it hikes up your interest rate.

The Effectiveness of Rate Locks During Volatile Periods

Imagine you’re shopping for the perfect pair of shoes. You find them but decide to think it over and come back later—only to discover that the price has jumped overnight. That’s a bit like trying to buy a home without a mortgage rate lock during volatile market periods; you could end up paying more than expected.

Mortgage rate locks are agreements with your lender that fix your interest rate for a set period, shielding you from sudden spikes while you hunt for houses or wait for closing day. It’s like reserving those dream shoes at yesterday’s prices, no matter how high demand soars tomorrow.

Peace of Mind in Unpredictable Markets

In New Hampshire’s real estate scene, where today’s mortgage rates can feel as unpredictable as New England weather, securing a locked-in rate is akin to carrying an umbrella on a cloudy day—you’ll be thankful when it unexpectedly pours. With current 30-year fixed mortgages averaging around 7.07% and 15-year terms at about 6.51%, savvy shoppers understand the value of certainty amid fluctuating numbers.

A solid rate lock strategy not only guarantees peace of mind but also helps maintain consistency in budgeting for what will likely be your biggest monthly expense: the mortgage payment.

Battling Against Budget Busters

Rising rates can wreak havoc on anyone’s financial planning efforts—particularly if they climb mid-search or during drawn-out negotiations and closings. When opting into this arrangement—a process known simply as “locking”—you essentially freeze time and price alike, keeping potential hikes from inflating your eventual monthly outlay or pushing ownership just beyond reach due to stricter loan approval requirements linked to higher costs.

This tactic isn’t free from nuance though; some lenders might charge upfront fees which should be weighed against potential savings (no one likes surprise charges any more than last-minute hikes). So while pondering whether this protective measure aligns with both need and timing within personal house-hunting sagas—it pays (quite literally) to compare offers diligently before committing.

Navigating Terms Without Turbulence

Finding clarity amidst complexity:

To steer clear through these choppy waters requires understanding each term thrown onto deck by loan officers—the duration being chief among them since most locks span anywhere between 15-60 days typically (though some stretch longer). If we liken our journey towards homeownership to navigating uncharted seas then foreseeing delays is essential because should paperwork stall beyond allotted timelines, extending existing agreements—or worse, needing new ones altogether—might result in additional costs depending on prevailing market rates. So it’s crucial to stay ahead of the schedule and communicate effectively with your lender to avoid any unexpected financial hiccups.

Key Takeaway:

Think of a rate lock like price protection for your mortgage; it keeps your interest rate safe from hikes during home-buying, offering peace of mind and helping you stick to your budget.

To sail smoothly through the home buying process in New Hampshire’s choppy market, get a grip on loan terms. Lock in rates to dodge unexpected cost spikes and keep an eye on timing to avoid extra fees if delays hit.

Exploring Additional Financial Products & Services

Mortgage rates in New Hampshire aren’t the only figures that savvy financial planners should keep an eye on. The world of finance offers a smorgasbord of options, from jumbo loans to gift cards, and each one has its own set of perks and quirks.

Personal Loans: More Than Just a Band-Aid for Your Wallet

A personal loan can be your financial Swiss Army knife; it’s versatile enough to cover anything from consolidating credit card debt to funding your dream wedding. With fixed interest rates typically lower than those of credit cards, this option gives you a predictable monthly payment that helps stabilize your budgeting efforts.

And if you’re worried about rate trends, fear not—personal loans usually lock in your interest rate so market fluctuations won’t ambush your wallet down the road. Shopping around is key here as lenders offer varied terms and rates based on factors like credit score and income levels. (Click here to apply.)

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

Your checking account might feel like a home base for managing day-to-day finances but don’t overlook its quieter cousin—the savings account. This dependable financial tool may not dazzle with high-interest payouts like other investments do; however, it offers unparalleled security along with some growth through accrued interest over time.

If we peek at annual percentage yields (APYs), they’ve been inching upwards lately due to Federal Reserve adjustments. And let’s face it—a solid savings stash could mean less reliance on things like payday loans when unexpected expenses pop up or even provide leverage when negotiating mortgage options down the line. Check this Savings Account that automatically transfers 10% of your deposits to an Autosave vault that earns a higher interest rate. I love this feature. It follows the rule of money that says “Pay Yourself First.” (Click here to open a savings account and receive a $325 reward.)

Navigating Small Business Ownership & Residential Mortgages

Small business owners in New Hampshire face a unique set of challenges when they step into the real estate ring. Securing a residential mortgage is not just about credit scores and down payments; it’s also about understanding how your entrepreneurial journey impacts your borrowing power.

Balancing Books and Borrowing: The Lender’s Perspective

Lenders look at more than just your income statement when you’re self-employed. They dig deep, peering over tax returns with a fine-tooth comb to get the full picture of your financial health. It makes sense; after all, owning a small business can mean having an income that zigzags like mountain roads—exciting but unpredictable.

To tilt things in their favor, savvy entrepreneurs prepare well before walking through those bank doors. They know lenders might ask for proof of steady income or evidence that their company isn’t just surviving but thriving—even if traditional profit markers are harder to come by.

And here’s where knowing mortgage options for small business owners becomes invaluable—you need every bit of knowledge as leverage during negotiations.

The Self-Employed Conundrum: Proving Your Worth Without W-2s

No W-2s? No problem—or so one would hope. But let’s be honest: this paperwork-paved path to homeownership does have its extra twists and turns without traditional employment records. Instead, you may find yourself presenting profit-and-loss statements or personal and business bank statements stretching back two years (or even longer).

Mortgage lenders in New Hampshire, much like anywhere else, aim to mitigate risk—and understandably so—but sometimes it feels like proving you’re not going to flake on them requires jumping through more hoops than a circus tiger.

Tax Deductions vs Mortgage Approvals: Striking the Right Balance

A classic catch-22 greets many self-employed individuals come tax time—a robust list of deductions lowers taxable income which is great for April 15th but less ideal when applying for mortgages later on since lower reported earnings can reduce borrowing potential significantly.

“But I’m making money.”, cries the frustrated entrepreneur.

Sure enough—the trick lies in finding a balance between smart tax strategies while maintaining an attractive profile as a borrower. This juggling act often means working closely with accountants who understand both sides of this coin.

Navigating these complexities underscores why exploring tailored solutions designed specifically around mortgage options available for small business owners proves crucial—it’s essential ammo when aiming towards homeownership targets.

Key Takeaway:

Small business owners in New Hampshire need to prep their finances and know the mortgage landscape. Lenders will scrutinize your financial health, so show them a thriving business, not just survival. Even without W-2s, you can prove your worth with detailed financial records. Remember: tax deductions can hurt loan approval chances—find that sweet spot where you look good for both taxes and lenders.

FAQs in Relation to Current Mortgage Rates in New Hampshire

What is the current interest rate in NH?

New Hampshire’s latest mortgage rates hover around 7.07% for a traditional 30-year fixed loan.

What is the average interest rate for a 30-year mortgage in New Hampshire?

The average sits at roughly 7.07%, aligning with today’s local going rates.

Will interest rates go down in 2024?

Rates could dip, but economic trends suggest they might hold steady or climb—keep an eye on market shifts.

What is the current going interest rate for mortgages?

Mortgage interests are dynamic; currently, they’re trending near that 7% mark nationwide.

Conclusion

So you’ve navigated the waters of current mortgage rates in New Hampshire. Now, you’re armed with knowledge. You know how local rates stack up against the national average and understand the ebb and flow of rate trends.

Let’s not forget about homebuyer programs that lend a hand to first-timers. They’re game-changers for many, easing those initial costs.

Digging into APR has shown its weight in your monthly mortgage payment—it’s vital for financial planning. Comparing lenders? That’s smart shopping; it could mean more money stays in your checking account each month.

You’ve got this. Secure that dream home with confidence, backed by solid insights and strategies fit just for you.

=============================================================================================================================

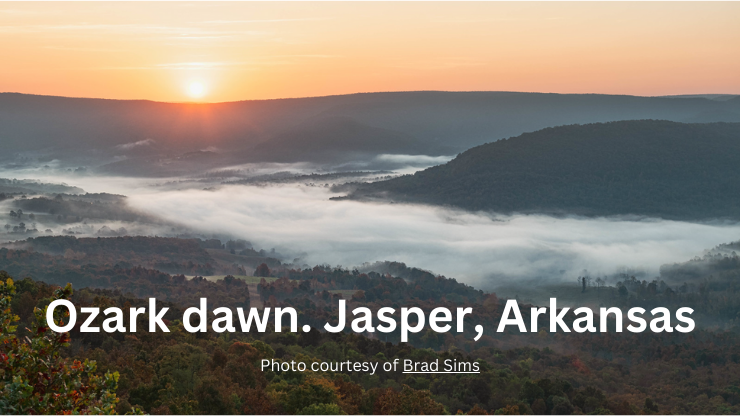

This would make a stunning addition to your brand-new home!

Check Out These Killer Tools and Resources…

-

Credit Repair Magic Will Fix Your Credit Fast.

-

Click Here To Fix Your Credit Fast.

-

Get a $300 bonus with a SoFi Personal Loan.

-

Click Here To receive your $300 bonus.

-

Find the right personal loan rate for you.

-

Click Here To Compare your options.

-

Compare More Loan Options to Choose From.

-

Click Here To Compare More Loan Options.

-

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

-

Click here to open a savings account and receive a $325 reward.)

Affiliate Link Disclaimer:

Please note that some of the links in this article are affiliate links, and

at no additional cost to you, I may earn a commission if you decide to make a purchase.

These links help to support me and allow me to continue providing valuable content to my readers.

Current Mortgage Rates in Alabama: Your Essential Guide

Let’s talk turkey about current mortgage rates in Alabama style, where the numbers are as hot as a southern summer. Just like that unexpected BBQ invite from your neighbor, today’s mortgage landscape in ‘Bama might surprise you.

Right now, folks looking to snag a piece of Southern hospitality need to know what they’re up against. With figures dancing around more than a square dance at a hoedown, it pays to keep an eye on the prize – or in this case, the price.

Current mortgage rates in Alabama offer plenty of chew for homebuyers and refinancers alike. By diving into this guide, y’all will uncover strategies for landing sweet deals on interest rates and learn how different types of mortgages could play out over grits and gravy—or decades-long commitments.

Table Of Contents:

- Current Mortgage Rates in Alabama: A Comprehensive Guide

- How to Find the Best Mortgage Rate in Alabama

- Mortgage Options Available to Alabama Residents

- First-Time Homebuyer Programs in Alabama

- Refinancing Your Mortgage in Rising Rate Environments

- Exploring Additional Resources for Mortgages in Alabama

- Understanding Credit Scores Impact on Your Mortgage Rate

- The Role of Property Taxes and Insurance on Monthly Payments

- FAQs in Relation to Current Mortgage Rates in Alabama

- Conclusion

Current Mortgage Rates in Alabama: A Comprehensive Guide

If you’re hunting for a place to call home sweet home in the Heart of Dixie, getting a grip on today’s mortgage rates can be as satisfying as a glass of sweet tea on a hot summer day. So let’s get right down to it. As we stand on January 9, 2024, if you’re eyeing that picturesque Southern abode with an expansive porch and room for your rocking chairs, knowing that the interest rate is pegged at 7.04% for a 30-year fixed mortgage could sway your decision.

The shorter-term commitment—a sprightly 15-year fixed mortgage—is currently dancing around at 6.42%. These numbers are not just digits; they represent how much grit you’ll have left over after paying off the monthly dues.

The Impact of Interest Rates on Long-Term Home Loans

A tick-up or down in interest rates might seem minuscule—like whether to add one more dollop of mayonnaise to your pimento cheese—but when spread across years and dollars, even small changes pack quite the punch.

Ponder this: opt for that traditional long haul—the 30-year fixed-rate mortgage—and every fraction of a percentage point affects not only what you pay each month but also piles onto what’s owed over those thirty years faster than kudzu climbing up an oak tree.

In contrast, commit yourself to fewer years with say, a 15-year term, and while monthly payments may rise like dough in Alabama humidity, you end up shelling out fewer clams overall. So, the question isn’t just about which rate sounds peachier—it’s about balancing immediate budgets against long-term savings.

Personalized Rate Comparisons

Finding the best deal isn’t always straightforward. It can feel like choosing between barbecue joints without tasting their secret sauces. That’s why savvy Southerners compare personalized rates from multiple lenders. You needn’t rely solely upon average statistics. When seeking out loans, it pays dividends (or rather, saves them) to investigate individualized quotes. Sometimes credit unions offer gems unseen elsewhere, and other times big banks bring competitive offerings. Best practice? Take advantage of these deals scoot away quicker than crawdads escaping from nets.

Key Takeaway:

Scoping out Alabama’s mortgage rates? Picture this: a 30-year fixed at 7.04% or a shorter, snappier 15-year at 6.42%. Each rate means more or less money for your grits stash—so think long-term costs vs. short-term spending.

Don’t just eye the average; hunt down personalized quotes from different lenders to net the sweetest deal on your Southern spread before it slips away like a speedy crawdad.

How to Find the Best Mortgage Rate in Alabama

Finding the best mortgage rate in Alabama is like hunting for hidden treasure. You know it’s out there, and with the right map and some local insight, you’re bound to strike gold—or at least a great deal on your home loan.

Personalized Rate Comparisons

First things first: don’t settle for average when you can get personalized rates that are tailored just for you. The secret sauce? Compare offers from multiple lenders. Just as Southern cooks have their special recipes, each lender has unique offerings that could sweeten your mortgage terms.

The journey starts by understanding what’s cooking in today’s market. As of January 9, 2024, we’re looking at an interest rate sitting pretty at 7.04% for a classic 30-year fixed mortgage—kinda like grandma’s time-tested pie recipe—and a slightly more modest 6.42% if you’re willing to commit to just 15 years.

Whether these numbers seem high or low depends on how they stack up against historical trends—a little context goes a long way. And let me tell ya’, knowing where rates stand now can help you find the best mortgage rate in Alabama. So put on your negotiation hat and start chatting with those friendly neighborhood loan officers who’ll gladly spill all their secrets—if asked nicely. Compare More Loan Options to Choose From. Click Here To Compare More Loan Options.

Leveraging Market Trends and Negotiations

Negotiating might sound daunting but think of it as haggling over peaches at the farmers’ market—you want ripe fruit without paying top dollar; the same goes for mortgages.

To charm those rates down even further into sweet southern comfort territory, use current economic factors along with real estate trends as leverage points during discussions with lenders—fluctuating job markets or recent shifts in housing supply can be valuable cards up your sleeve.

Utilizing Points and Other Cost-Saving Measures

Mortgage points are kind of like seasoning—it doesn’t take much before everything tastes better (or costs less). Buying discount points lowers your interest percentage rate upfront which means lower monthly payments later on down the road; sort of akin to putting money away during bountiful times so future meals feel less heavy financially speaking.

- Evaluate if buying points make sense based upon how long you plan on staying put—in other words: will this house become part of family history?

- Analyze closing costs since these vary wildly among lenders faster than hot gossip spreads through small towns. Remember: sometimes ‘no-cost’ loans simply bake fees into higher interest rates instead—they’re sneaky like that.

- Last but not least, we ensure every detail is attended to with the utmost professionalism.

Key Takeaway:

Don’t just go with the first mortgage rate you find—dig around for a deal that’s cooked up just for you. Compare lenders, negotiate using market trends, and consider buying points to lower your interest over time. Watch out for those closing costs though; they can vary more than Alabama weather.

Mortgage Options Available to Alabama Residents

Shopping for a home in the Heart of Dixie brings its own flavor of southern hospitality, but it’s the mortgage options that really give buyers something to smile about. Whether you’re buying your first home or refinancing, understanding what’s on offer can help you find a sweet deal.

Fixed vs. Adjustable-Rate Mortgages

In Alabama, fixed-rate and adjustable-rate mortgages are like two sides of the same coin—each with distinct advantages depending on your financial goals and risk tolerance. A 30-year fixed-rate mortgage promises stability; lock in today’s rate, and you’ll pay the same amount every month until those Crimson Tide banners fade—or at least for 15 or 30 years.

An adjustable-rate mortgage (ARM), however, is more akin to riding an elephant—it might start off smooth but hold tight because after that initial period ends, rates could climb higher than Vulcan’s torch in Birmingham’s skyline. Yet if flexibility is key for you or perhaps another stint out-of-state beckons within a few years—an ARM could be just right.

The current rates tell us one story: security comes with slightly higher costs whereas adaptability may initially be cheaper but carries future uncertainty—a classic tortoise versus hare scenario.

Federal Housing Programs and Loan Types

If this isn’t your first rodeo—or rather house hunting expedition—you know federal housing programs are there to wrangle up some support when needed. For new folks joining us on this trail ride through real estate prairies, let me introduce these friendly companions designed by Uncle Sam himself.

FHA loans have been helping Alabamians plant their roots since way back when tailgates didn’t involve fancy trucks—and they’re still here offering low down payments perfect for those without a treasure chest under their bed. Then we’ve got VA loans waving American flags high as they march toward veterans providing unbeatable deals sans down payment. And USDA loans? They don’t just care about how juicy your peaches grow—they’ll get rural residents into homes faster than hot biscuits disappear at breakfast time.

Learn more about loan types available specifically tailored for Alabamians here.

Note: The numbers dance daily so snagging an expert who knows all too well how interest rates move can save thousands over time—not unlike clipping coupons before heading to Piggly Wiggly.

is left unturned. Diving into the fine print can uncover potential savings, and it’s wise to keep an eye out for fees that could sneak up on you. Remember, shopping around isn’t just about finding the lowest rate—it’s also about securing terms that fit your financial situation like a glove.

Key Takeaway:

Alabama’s mortgage options, from fixed-rate stability to ARM flexibility, cater to diverse financial goals. Federal programs like FHA and VA loans offer unique benefits for homebuyers, so grab an expert guide and dive into the details to land a deal as fitting as a well-worn baseball glove.

First-Time Homebuyer Programs in Alabama

Becoming a homeowner for the first time is like stepping onto a roller coaster—thrilling, slightly terrifying, but ultimately rewarding. And when you’re riding that rollercoaster in Alabama, there’s southern hospitality waiting to give you a boost. That help comes from state-specific initiatives aimed at easing the journey into homeownership.

Navigating Down Payment Assistance Programs

The road to owning your home often starts with one of the biggest hurdles: the down payment. But don’t fret; Alabama rolls out the welcome mat with several down payment assistance programs tailored specifically for first-time buyers. These programs are lifesavers because they can bridge the gap between what you have and what you need to make your dream of owning a home come true.