Navigate Arkansas Mortgage Rates: Your Guide to Home Loans

Picture this: You’re standing on the cusp of owning a piece of The Natural State, your very own home nestled in Arkansas’s lush landscapes. But there’s a catch—the ever-shifting sands of mortgage rates in Arkansas. Today, you might see figures like 7.05% for a 30-year fixed mortgage dancing before your eyes, but what does that mean for you and your wallet?

Don’t worry; we’ve got your back. This guide will walk you through current rates first-time buyer perks and refinancing options.

You’ll also get the scoop on different loan types available right here in Arkansas—everything from FHA loans to those elusive VA loans if you’ve served our country.

So buckle up! We’re diving into the world where credit scores meet closing costs—and how it all affects that monthly payment hitting your bank account.

Table Of Contents:

- Current Mortgage Rates in Arkansas

- Navigating First-Time Homebuyer Programs in Arkansas

- Navigating First-Time Homebuyer Programs in Arkansas

- Refinance Options for Arkansans

- Understanding Different Types of Mortgages Available in Arkansas

- FAQs in Relation to Mortgage Rates in Arkansas

- Conclusion

Current Mortgage Rates in Arkansas

Scouring the web for current mortgage rates in Arkansas can feel like searching for a needle in a haystack, but here’s the scoop. As of now, if you’re looking to snag a 30-year fixed mortgage, you’re looking at an average rate of about 7.05%. Want something shorter? A 15-year fixed loan is averaging around 6.57%. These numbers aren’t just digits on a screen—they could be your ticket to calculating how much home sweet home will actually cost.

How Today’s Rates Affect Your Mortgage Payment

The dance between Arkansas mortgage rates and your wallet is one worth paying attention to. Let me break it down: with today’s rates, every percentage point shift has its own financial choreography that impacts what comes out of your pocket each month.

A quick twirl with a mortgage calculator shows us this—if you take out that typical loan at today’s rate for an average-priced home in The Natural State (let’s say $200k), expect monthly payments reaching upwards into four figures before taxes and insurance pirouette onto the scene.

This isn’t just talk; let these numbers guide your budget plans because they’re as real as the bricks and mortar you’ll hopefully call yours soon enough.

Navigating First-Time Homebuyer Programs in Arkansas

If deciphering mortgages was like hacking through jungle underbrush with a machete, first-time homebuyer programs are more like stumbling upon an ancient map—a bit complex but leading toward treasure. And by treasure, I mean potential savings or support during this epic quest called homeownership.

ADFA Move-Up Loan Program Overview

Intrigued by moving up from cozy starter digs? Well, step right up. ADFA Move-Up Loan might just fit the bill. It offers competitive interest rates for those who’ve owned before yet are craving fresh walls without squeezing wallets dry—talk about being kinder than most fairy godmothers.

To join this ballroom bash though, there are partners involved—lenders approved by ADFA—and steps to learn (like income limits) so check them out thoroughly so when it’s time to move up it goes smoother than waltzing across polished marble floors.

Accessing Down Payment Assistance

Sometimes getting together enough cash upfront feels tougher than herding cats while balancing teacups—but fear not. There exists payment assistance worthy of applause designed especially for Arkansan newbies diving into their first property purchase venture.

Take a closer look at the options out there. You might just uncover some real treasures, like grants or loans you don’t have to pay back.

Comparing Mortgage Lenders and Loan Offers in Arkansas

Surely nobody walks into an ice cream shop asking for vanilla without even glancing at other flavors. That same zest should apply when shopping around for mortgages by comparing various lender sprinkles—that could mean big savings over life-of-loan sundaes.

Cue preapproval—a ticket showing what kind of sundae dish you can fill without toppling over financially speaking—which also puts sellers’ minds at ease faster than calming Great Salt Lake waves during storm season. Compare More Loan Options to Choose From. Click Here To Compare More Loan Options.

Key Takeaway:

Scanning for Arkansas mortgage rates? Here’s the deal: a 30-year fixed loan averages 7.05%, and a 15-year sits at about 6.57%. This means your monthly payment could easily hit four figures, so plan your budget with these numbers in mind.

Diving into homeownership as a newbie? Check out first-time buyer perks like the ADFA Move-Up Loan Program for better rates, but watch those income limits to dance smoothly through the process.

Struggling with that initial down payment chunk? Arkansas offers help worth cheering—think grants or no-payback loans to kickstart your home-buying adventure. Get a peek at your credit report annually, because flying blind through finances is scarier than encountering a moose while hiking Wasatch Front trails.

Navigating First-Time Homebuyer Programs in Arkansas

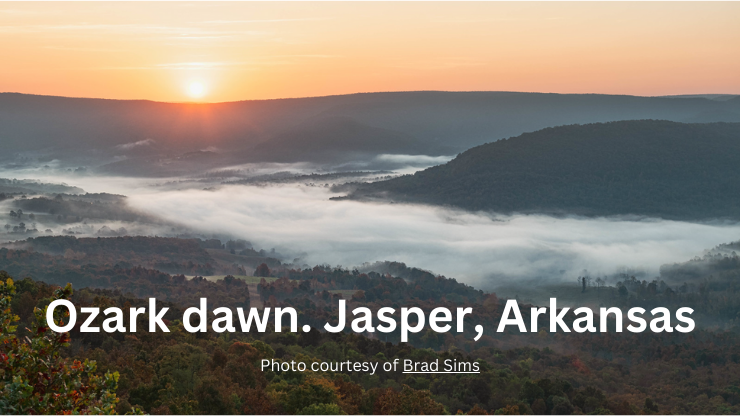

Arkansas offers a cozy haven for first-time homebuyers, with its vibrant communities and scenic beauty. But let’s face it, stepping into the world of homeownership can feel like hiking the Ozarks—thrilling yet daunting. Luckily, programs tailored for Arkansans new to this adventure exist to make sure you don’t get lost in the financial woods.

ADFA Move-Up Loan Program Overview

The ADFA Move-Up loan program is like that trusty compass guiding established residents towards their next abode. It’s perfect if your starter home feels more like a tight squeeze these days and you’re itching to move up. The initiative caters not just to rookies but also those who’ve played the game before—a breath of fresh air considering most assistance schemes cater only to newcomers on the property ladder.

This particular program has charm; it gives a leg-up by offering competitive rates making it easier on your wallet over time. Imagine pairing one of these loans with today’s mortgage rates hovering around 7.05% for a 30-year fixed or 6.57% for something shorter—you could snag quite the deal. So while Benton County might be calling your name as an idyllic spot for your primary residence, ADFA Move-Up ensures affordability doesn’t slip through your fingers.

Accessing Down Payment Assistance

Dreams are great until they meet reality—and down payments often crash many housing dreams back down to earth hard and fast. But here comes payment assistance swinging in from stage left. For first-timers feeling cash-strapped or looking at real estate prices with wide eyes, available options offer some solace without having you empty every piggy bank in sight.

If we roll out numbers (because who doesn’t love good stats?), help is no stranger here: think lower monthly mortgage obligations thanks especially to plans providing chunks of funds upfront so that dreaded initial cost isn’t such an ogre after all. Consider exploring federal housing loan programs alongside local offerings, because when combined wisely—they create powerful allies against traditional financial barriers blocking would-be buyers’ paths toward homeownership bliss.

Key Takeaway:

Arkansas rolls out the welcome mat for first-time homebuyers with programs that make owning a home less of a financial fairy tale. The ADFA Move-Up loan shines by offering competitive rates to both newbies and veterans of homeownership, while down payment help is ready to catch you if the upfront costs threaten your dream.

Refinance Options for Arkansans

Arkansas homeowners, it’s time to sharpen your pencils and dust off that calculator. With mortgage refinance rates bobbing up and down like a canoe on the Buffalo River, now might be the golden hour to consider adjusting those loan terms.

When to Consider Refinancing Your Home Loan

If you’re eyeballing your monthly statement with more sighs than smiles, refinancing could be your ticket out of high-rate town. But don’t just leap at the sound of dropping rates; think about where you stand financially first. If that credit score has climbed since you first signed those papers or if equity in your home has bloomed like spring dogwoods, then congrats. You’ve likely hit a sweet spot for scoring better terms.

Mortgage refinance options in Arkansas are ripe for picking when market conditions feel right as rain after a summer scorcher. Did I hear someone mention ‘lower interest rates’? Yes indeed – they can help ease the burden of what feels like an eternal mortgage payment slog by reducing long-term costs or even giving monthly expenses some breathing room.

To make heads or tails of whether this is the right move for you though, chew over things like closing costs against how much longer you plan on calling your current digs ‘home sweet home’. A quick chat with seasoned loan officers, armed with today’s savvy online investing tools, will give insights into whether it’s smart money talk—or just talk.

Navigating Current Refinance Rates in The Natural State

Buckle up because navigating these waters takes some finesse—think whitewater rafting through Cossatot River rapids level of focus here folks. Current refi rates have been known to do-si-do around 7% but remember: this isn’t a one-size-fits-all hoedown.

Your neighbor may crow about their sub-6% rate while yours is pecking around 7%, so before pulling any triggers based solely on jealousy-induced impulse decisions (we’ve all been there), pause and ponder why theirs might differ from yours—it often comes down to personal financial situations rather than just luck o’ draw.”

Finding Your Best Mortgage Refinancing Match

A little birdy told me Benton County offers different vibes compared to Calhoun County when we’re talking real estate – which means local lenders understand these nuances too. They’ll juggle factors such as debt-to-income ratio faster than clowns toss bowling pins at the county fair—all to get you a loan that fits just right. So, when you’re ready to dive into the housing market here, rest assured these pros have got your back every step of the way.

Strengthen Your Credit Score

A strong credit score doesn’t just open doors; it also lowers interest rates. Think of your credit score as a financial report card that lenders use to decide if you’re worthy of a low rate. To beef up your score, start by snagging a free copy of your credit report from AnnualCreditReport.com. Look for errors and get them fixed ASAP.

Paying bills on time is like hitting home runs for your credit history—it boosts your average big time. And let’s not forget about debt—knocking down high balances can make lenders eager to give you better terms when it comes to loan options. Do you have a low credit score? Here’s a link to help you increase your credit score. Credit Repair Magic Will Fix Your Credit Faster than Any Other Credit Repair System at Any Price. . .Guaranteed! Click Here To Fix Your Credit Fast.

Key Takeaway:

Arkansas homeowners now’s a prime time to see if refinancing can save you cash. Check your credit score and home equity first – they might just be your golden ticket to better loan terms. Remember, local pros are ready to tailor a refi deal that fits like a glove.

Understanding Different Types of Mortgages Available in Arkansas

If you’re looking to plant roots in the Natural State, knowing your mortgage options can turn a mountain of uncertainty into a molehill. With an array of loans that range from adjustable-rate mortgages to jumbo loans, each type has its perks and quirks.

Adjustable-Rate Mortgage: The Flexible Friend or Foe?

An adjustable-rate mortgage (ARM) is like Arkansas weather—predictably unpredictable. Initially sweet with lower rates, ARMs eventually adjust based on market trends. They’re great if you plan on moving before the rate changes but risky if you don’t want future surprises affecting your budget.

Borrowers might choose an ARM for its initial cost savings; however, they must be ready for potential rate increases down the line. To stay informed about where these rates stand today and how they could impact your monthly payment down the road, checking out current mortgage rates in Arkansas regularly is wise.

The Tried-and-True Conventional Loans

A conventional loan is as traditional as it gets when buying a home—and sometimes tradition wins out. These are typically fixed-rate mortgages offering stability over 15 to 30 years terms—the kind of long-term relationship some borrowers find comforting. They often require higher credit scores and larger down payments but owning a piece of Benton County without any strings attached (like government backing) feels downright liberating.

To snag one at competitive loan rates making sure your credit score doesn’t look like it’s been through a tornado will help immensely because lenders see those three digits as proof that you’ll keep up with payments just fine.

FHA Loans: A Helping Hand for First-Time Homebuyers

Federal Housing Administration (FHA) loans swoop in like superheroes for first-time buyers or folks who’ve hit rough patches financially. Requiring smaller down payments and being more forgiving on credit hiccups make FHA loans appealing—especially considering average Arkansas prices won’t leave your wallet feeling empty after closing costs either.

Arkansas’s fair market ensures that FHA limits remain within reach even if Calhoun County calls out to you with its rural charm—but always remember every superhero has their kryptonite; PMI (private mortgage insurance) sticks around longer than most would prefer here.

Veterans Affairs (VA) Loans: Saluting Service Members

Serving our country comes with benefits including access to VA loans—a financial salute. Zero percent down? No PMI? It sounds too good but it’s true. Eligible veterans looking at real estate can use this benefit repeatedly throughout their lives—as sturdy as the foundation under any home they choose. These loans offer a solid stepping stone into homeownership, honoring those who’ve served with terms that make buying a house more achievable.

Key Takeaway:

Getting to know Arkansas’s mortgage options can simplify your home-buying journey. From ARMs’ initial low rates with future uncertainties to conventional loans’ stable long-term relationships, and FHA’s smaller down payments for first-timers—there’s a fit for everyone. And let’s not forget VA loans: they salute service members with perks like zero down and no PMI.

Exploring Additional Financial Products & Services

Mortgage rates in Arkansas aren’t the only figures that savvy financial planners should keep an eye on. The world of finance offers a smorgasbord of options, from jumbo loans to gift cards, and each one has its own set of perks and quirks.

Personal Loans: More Than Just a Band-Aid for Your Wallet

A personal loan can be your financial Swiss Army knife; it’s versatile enough to cover anything from consolidating credit card debt to funding your dream wedding. With fixed interest rates typically lower than those of credit cards, this option gives you a predictable monthly payment that helps stabilize your budgeting efforts.

And if you’re worried about rate trends, fear not—personal loans usually lock in your interest rate so market fluctuations won’t ambush your wallet down the road. Shopping around is key here as lenders offer varied terms and rates based on factors like credit score and income levels. (Click here to apply.)

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

Your checking account might feel like a home base for managing day-to-day finances but don’t overlook its quieter cousin—the savings account. This dependable financial tool may not dazzle with high-interest payouts like other investments do; however, it offers unparalleled security along with some growth through accrued interest over time.

If we peek at annual percentage yields (APYs), they’ve been inching upwards lately due to Federal Reserve adjustments. And let’s face it—a solid savings stash could mean less reliance on things like payday loans when unexpected expenses pop up or even provide leverage when negotiating mortgage options down the line. Check this Savings Account that automatically transfers 10% of your deposits to an Autosave vault that earns a higher interest rate. I love this feature. It follows the rule of money that says “Pay Yourself First.” (Click here to open a savings account and receive a $325 reward.)

FAQs in Relation to Mortgage Rates in Arkansas

Is 3.75 a good mortgage rate today?

In the past, 3.75% was considered a stellar mortgage rate, but rates have climbed recently. It’s important to check Arkansas’s current average mortgage rate for context.

What is the current interest rate in Arkansas?

The latest figures show that Arkansas’s 30-year fixed mortgage rate is about 7.05%, with some daily fluctuation.

What are 30-year mortgage rates right now?

Currently, mortgage rates for 30-year loans hover around the mid-7s nationally. However, local factors may slightly influence this number in Arkansas.

Will mortgage rates go down soon?

Mortgage rates can shift quickly, often depending on broader economic indicators. It’s important to stay tuned to forecasts for hints about future rate changes.

Conclusion

Wrapping up, and understanding mortgage rates in Arkansas is key. You’ve learned that today’s rates could mean a 7.05% APR for your dream home in The Natural State.

Remember the programs we discussed? They’re here to help, especially if you’re buying for the first time or looking to move up with an ADFA loan.

Dig into those refinancing options when it makes sense—lower interest might be just around the corner. And let’s not forget all those mortgage types available; there’s one that fits just right for you.

You now have what it takes to navigate this journey smartly and confidently. So go ahead, take control of your future—one where monthly payments don’t seem so daunting anymore.

=============================================================================================================================

This would add a touch of elegance to your living room in your brand-new home!

Check Out These Killer Tools and Resources…

-

Credit Repair Magic Will Fix Your Credit Fast.

-

Click Here To Fix Your Credit Fast.

-

Get a $300 bonus with a SoFi Personal Loan.

-

Click Here To receive your $300 bonus.

-

Find the right personal loan rate for you.

-

Click Here To Compare your options.

-

Compare More Loan Options to Choose From.

-

Click Here To Compare More Loan Options.

-

Savings Accounts: A Safe Harbor for Your Hard-Earned Cash

-

Click here to open a savings account and receive a $325 reward.)

Affiliate Link Disclaimer:

Please note that some of the links in this article are affiliate links, and

at no additional cost to you, I may earn a commission if you decide to make a purchase.

These links help to support me and allow me to continue providing valuable content to my readers.

- Current Mortgage Rates in Illinois: Save Smart!

- Georgia Mortgage Rates Guide: Save Big Now

- Your Guide to Unlock the Best Mortgage Rates Florida Today

- Navigate California Mortgage Rates Today: Ultimate Savings Guide

- Navigate Utah Mortgage Rates Today: Your Guide to Savings

- Missouri Mortgage Rates: Your Guide to a Better Home Loan

- Navigating Louisiana Mortgage Rates: A Homebuyer’s Guide

- Current Mortgage Rates in Delaware: Your Guide to Savings

- Navigating Mortgage Rates in New Mexico: A Homebuyer’s Guide

- Secure Lower Refinance Rates in Arizona: Your Guide to Savings

- Alaska Mortgage Rates: Your Guide to Affordable Home Loans

- Current Mortgage Rates in New Hampshire: Save Big Now

- Current Mortgage Rates in Alabama: Your Essential Guide

- Navigate Arkansas Mortgage Rates: Your Guide to Home Loans

- Understanding Current Mortgage Rates in Mississippi: A Guide

- Navigating Minnesota Mortgage Rates: A Homebuyer’s Guide

- Navigate Nebraska Mortgage Rates: Your Guide to Savings

- Navigating Mortgage Rates in Montana: A Homebuyer’s Guide

- Vermont Mortgage Rates: Smart Strategies for Homebuyers

- Current Mortgage Rates in Indiana: Your Guide to Savings

- Navigate Kentucky Mortgage Rates for Smart Home Financing

- Navigate Rhode Island Mortgage Rates: Your Complete Guide

- Navigate Maryland Mortgage Rates: Your Guide to Savings

- Secure Lower Refinance Rates Colorado: A Homeowner’s Guide

- Current Mortgage Rates in Oregon: Your Guide to Savings

Leave a Reply